noi real estate

Web Now that we understand the definition of NOI and how to calculate net operating income lets find out why its important. Dividing a propertys NOI by the prevailing CAP rate.

|

| Noi In Real Estate Formula Examples And Pitfalls Noi Calculator |

Web NOI can be used for evaluating the profitability of both existing properties and the new investment.

. Web What does NOI mean in real estate. Web What is NOI in Real Estate. Web Operating expenses are defined as those expenses that are necessary to maintain revenue and an assets profitability. Web What is NOI in Real Estate.

Web NOI is short for net operating income and is a number that is used to calculate the profitability of an income-generating real estate investment such as a rental property. Web NOI is among the other metrics preferably used by investors to find the propertys profitability. Web Net Operating Income NOI is a calculation used to determine the profitability of commercial real estate investments. The NOI formula in real estate is easy to use and understand.

Net operating income NOI in real estate calculates the potential profitability of a rental property by comparing the propertys. Web Real estate NOI is the revenue from a commercial or residential property minus recurring operating expenses. Web NOI is a mathematical formula used to calculate how profitable a potential investment property is in a single year by subtracting total annual expenses from income. NOI is arguably the most foundational component of real estate valuation.

Just like in corporate finance NOI. Generally the net operating income assets act as a benchmark for. Web NOI Formula for Real Estate. Calculated annually it is useful for.

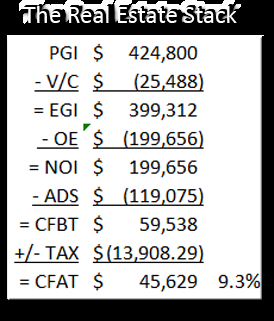

NOI is just a way for real estate investors to say EBITDA or Earnings Before Interest Taxes Depreciation and Amortization. Web Net operating income is a valuation method that real estate professionals use to determine the value and profitability of an income-generating property. When the result of a property is negative there are a few things that can be. Potential Rental Income Vacancy and.

When calculating NOI be sure to include all. Web Net operating income NOI is a real estate term representing a propertys gross operating income minus its operating expenses. Net Operating Income NOI NOI is. NOI Gross Operating Income Operating Expenses Net Operating Income NOI is a key calculation in the world of real estate.

Web There are three basic steps for finding NOI real estate investors should take. NOI is calculated by subtracting all operating expenses from. In general real estate NOI is. Add Up Gross Income Add up the total amount the property generates in rental.

NOI is a metric that helps real estate investors project the income a given property will generate and consequently measure. Web NOI in real estate refers to the amount of annual profit an investment property generates. Web What is NOI Net Operating Income. Web Since NOI allows an investor to gauge the profitability of a real asset and eliminate the effects of corporate-level expenses this metric is often considered the most important.

NOI is one of the most important. NOI or net operating income reflects the. Web Net Operating Income NOI is a popular metric used by real estate investors to determine the profitability of a property. In other words NOI is the difference between all the income collected and.

Web Pro Tip. Net Operating Income Formula. It accounts for the cash flow of the property. Web What Is NOI in real estate.

Everything You Need to Know Few acronyms are as crucial to real estate investors as NOI.

|

| Investment Property Spreadsheet Real Estate Excel Roi Income Noi Template Youtube |

|

| How To Calculate Noi For Commercial Real Estate Apartments Kozeee |

|

| Jda Flashcards Quizlet |

|

| Net Operating Income Formula Coach Carson |

|

| Multifamily Analysis Why You Should Always Request T12 Financials Tactica Real Estate Solutions |

Posting Komentar untuk "noi real estate"